Some estimates indicate as many as 50–80% of retired professional athletes go bankrupt within five years of retiring.

The statistics vary somewhat, and they depend on the sport played, but that’s a blistering indictment of the financial planning and professional advice that athletes are getting. The reasons for the breakdown of professional fiduciary responsibility are many, but, while the athlete bears a certain degree of culpability, a team-based advisory approach carries the best hope of long-term success.

Most recent college graduates are not trained in financial planning, budgeting, or the tax system, much less the more complex and esoteric aspects of high-income wealth management.

The seemingly simple task of managing the daily household finances for a high-net-worth family can quickly become an overwhelming, time-consuming burden. Combine that with the almost perpetual demands of being an elite athlete, and the need to “outsource” the management of the finances becomes clear and necessary. While the need to outsource such financial responsibility is neither unique to, nor inherently detrimental to athletes, the way in which it is often handled leads to many avoidable problems. Often those critical tasks are being delegated to a single family member, friend, agent, or in some cases even former coach. With no oversight, no variety of viewpoints, no checks and balances, it is easy for a situation to spiral out of control.

The Perfect Starting Lineup

As most athletes are already accustomed to being team players, impressing upon them the benefits of a team-based approach to their financial planning and wellbeing should resonate with them. Just as any team sport requires that multiple people — each with unique skills, expertise, and experience — come together to form a well-functioning, cohesive unit, good financial planning benefits from the same interplay and checks and balances of a diverse, yet distinct, set of specialists. In order to ensure the best possible long-term results for the entire “team” multiple, independent advisors must be engaged: each responsible for certain aspects of an athlete’s overall financial health, and all of them working together to achieve a positive outcome — not only for themselves but for their mutual client.

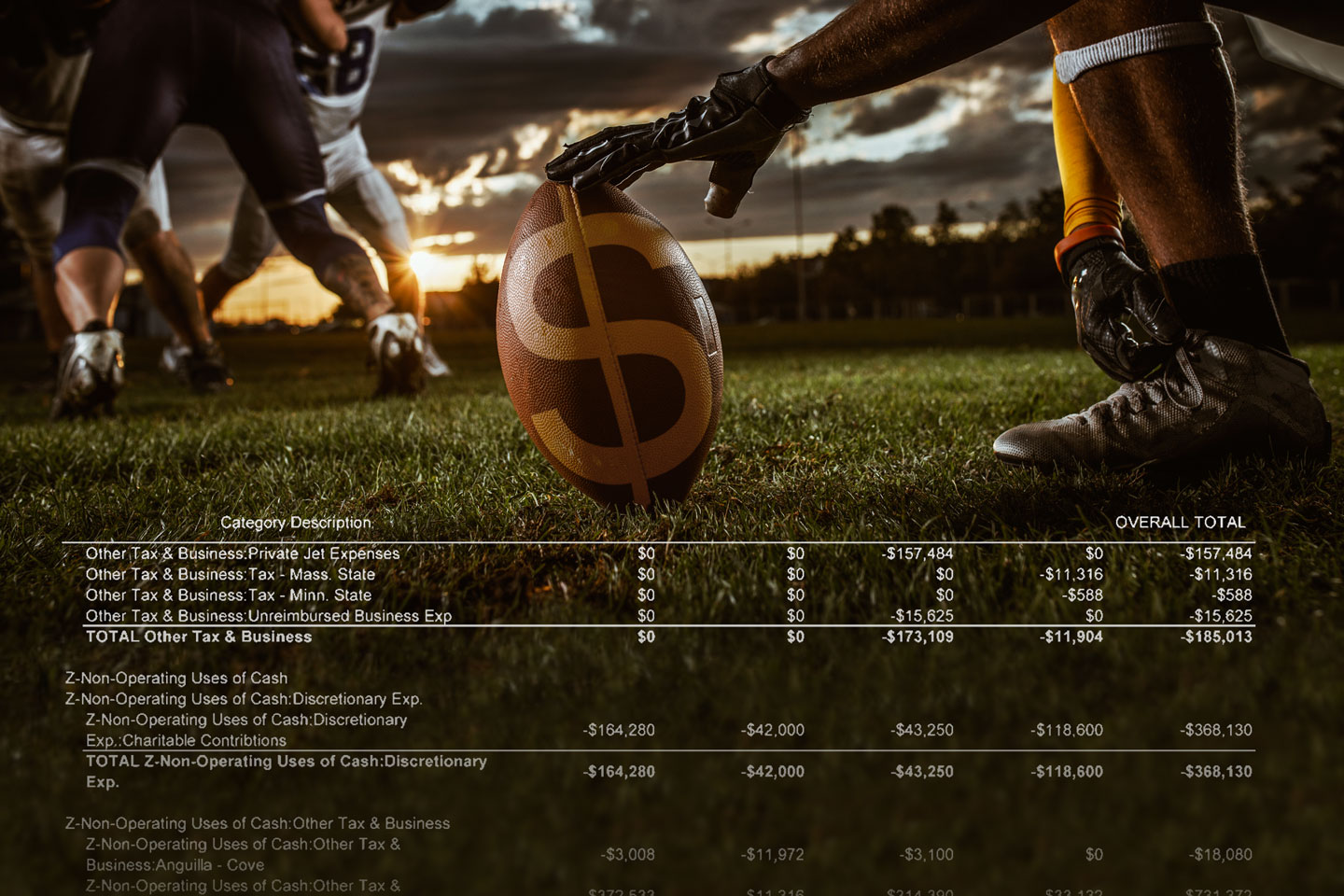

For over 30 years My Accountant, Inc. has been helping high earners understand their spending. As a new client recently told us when reviewing our year-end cash flow report for the first time, “I had a feeling it was a lot, but now I can no longer deny it; there it is in black and white. Every penny.”

One critical role that is often missing is someone to monitor and report on the day-to-day spending – the operating costs of households, the credit card charges that slowly accumulate, the luxury spending that could be better managed, etc. Financial advisors may be able to quantify where large chunks of money go, i.e. investments, real estate, etc., but few can account for the seemingly innocuous trickle of daily spending.

One critical role that is often missing is someone to monitor and report on the day-to-day spending – the operating costs of households, the credit card charges that slowly accumulate, the luxury spending that could be better managed, etc. Financial advisors may be able to quantify where large chunks of money go, i.e. investments, real estate, etc., but few can account for the seemingly innocuous trickle of daily spending.

A Clear Gameplan

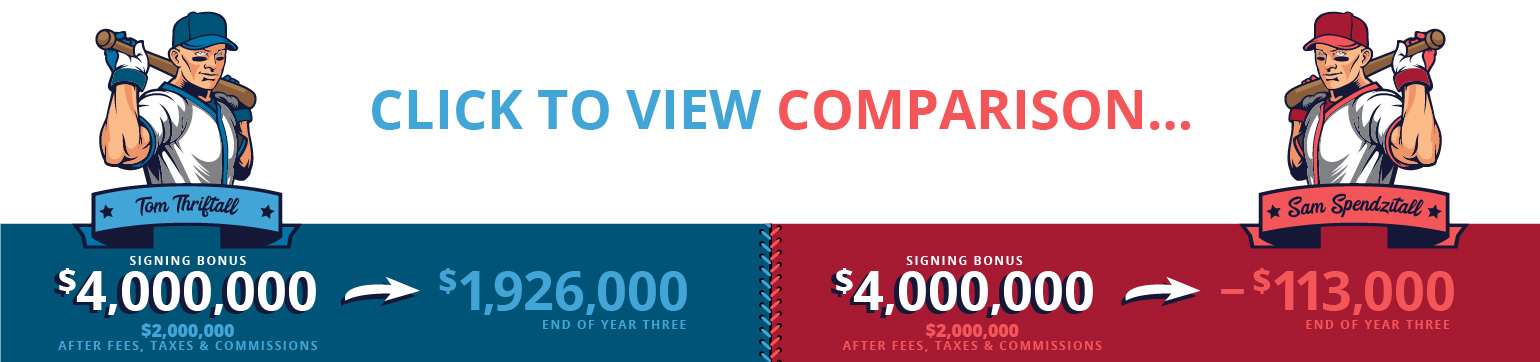

Elite athletes are intelligent, capable people able to make good decisions given good information. Clear, concise, understandable reports, devoid of unnecessary jargon and tailored to the needs of the athlete, can provide clarity in that decision-making process. What-if scenarios that illuminate the pros and cons of a given decision — and team-based, quality advise founded on accurate, timely information — can make the difference between long-term financial viability and near-term financial ruin.

With a dedicated, multidisciplinary team of professionals to help educate, inform, and in some cases even challenge the life choices of a young athlete, a solid foundation can be laid for long term financial health. Good information, good advice, and good communication can make the difference between a catastrophic life-changing bankruptcy and a successful long-term future.